Forex trading strategy #18 (Teodosi Moving Averages' tunnels)

This Forex system was submitted by Teodosi.

Thank you!

We value your great efforts to help us building this free Forex strategies resource

where traders all over the world can find answers about Forex and pick up ideas that

will improve their trading!

-----------------------------------------------------------------------------------------------------------

"Hello guys i want to help all of you and i want to share you some good system.

Like many traders say good system is simple one an that`s why i`ll tell you one very simple.

This is......

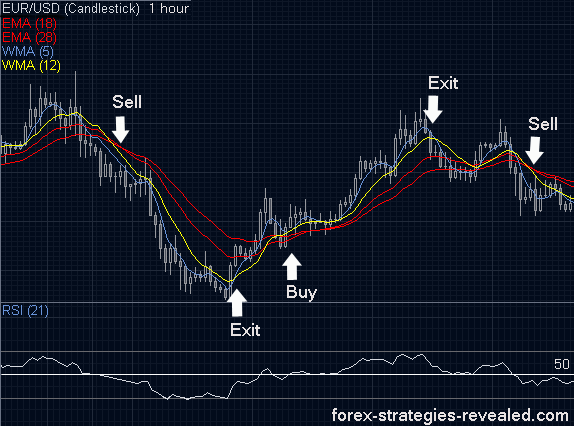

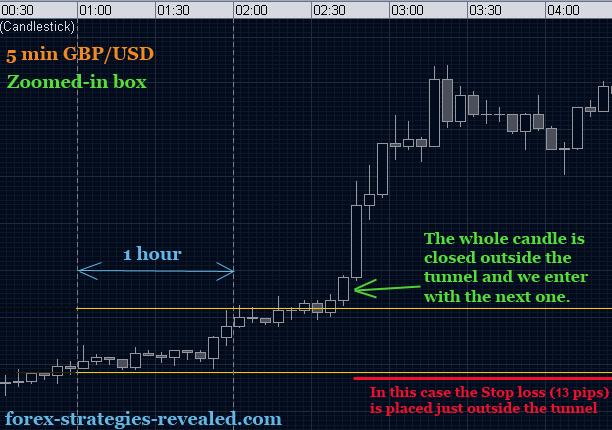

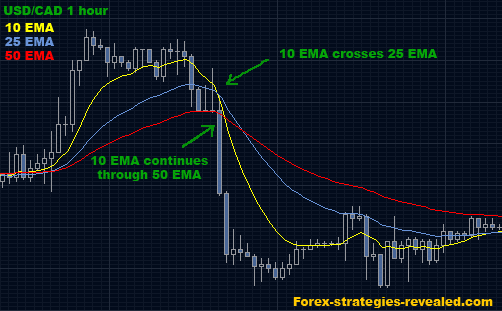

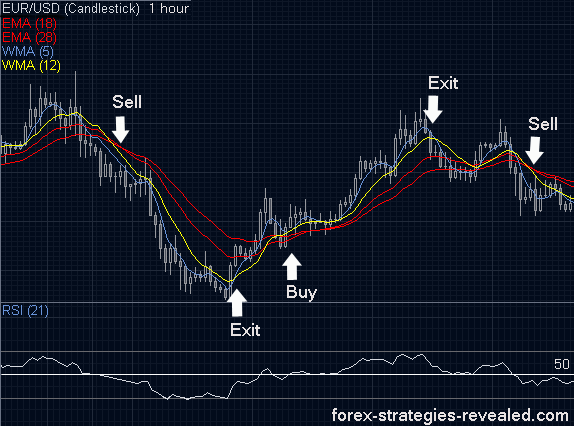

- 1H (of 30MIN, but you will get more whipsaws) candlesticks/bar charts

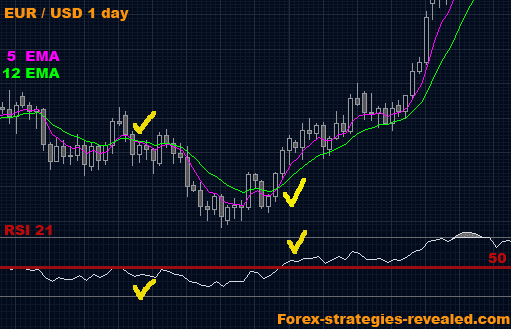

- 18 EMA & 28 EMA (put them in red)

- 5 WMA (in blue) & 12 WMA (in yellow)

- RSI = 21

The 18 EMA & 28 EMA are two red lines who form a tunnel, these will help you to determine the start of a rend and the end of a trend.

Long term

The 5 WMA & 12 WMA will show you when to enter a trend, they will also

help you to see the strength of the trends. Short term

Entry Signals

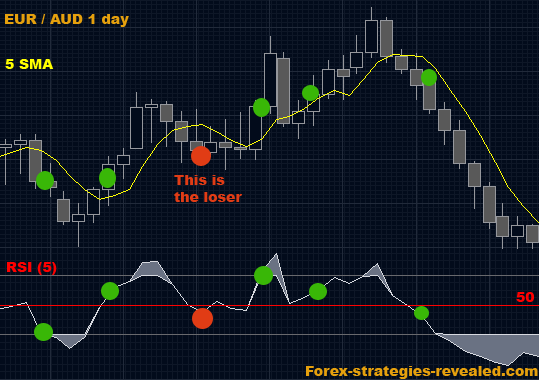

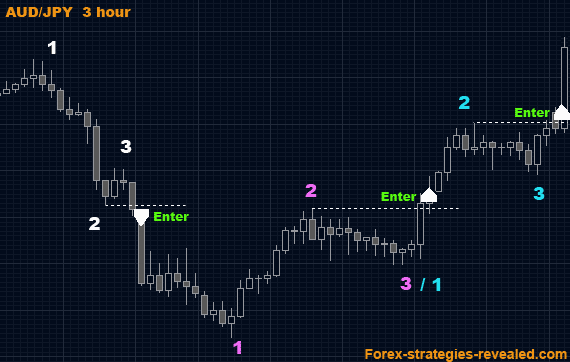

You should only open a position, when the red tunnel is extremely narrow or crossed!

LONG: 5 WMA & 12 WMA cross the red tunnel upwards.

If the 5 WMA also crosses the 12 WMA upwards, then the signal is extra strong.

RSI >50

SHORT: 5 WMA & 12 WMA cross the red tunnel downwards.

If the 5 WMA also crosses the 12 WMA downwards, then the signal is extra strong.

RSI<50

Exit Signals

Signals that show the end of the chosen trend

- Long: The price has reached a top and 5 WMA dives under 12 WMA

Close position

- Short: The price has reached a bottom and 5 WMA jumps above 12 WMA

Close position

Always close your position when boundaries of the red tunnel cross eachother

or when they become so narrow that they are one! This is a clear sign of a trend reversal.

After you see this, close your position and open a new position in the other way

(If you were long, close, open a short position)

When in a trade and the 5 WMA & 12 WMA cross the red tunnel ->

Pay attention! As long as the red tunnel boundaries doesn’t cross

eachother there is no problem, but often this is a sign that they will!"

Teodosi

-----------------------------------------------------------------------------------------------------------

What else can we say? Well done, Teodosi!

Thank you from all our users for sharing the system!

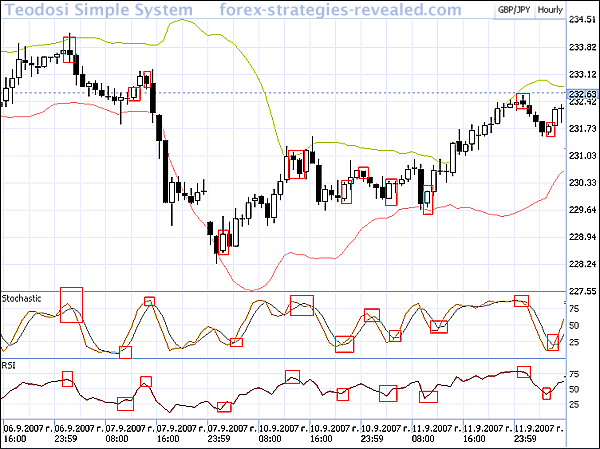

Learn about another Simple system by Teodosi

at

http://forex-strategies-revealed.com/teodosi-simple-system