Forex trading strategy #29 (Stochastic + EMAs' cross)

Submitted by Arsalan

------------------------------------------------------------------------------

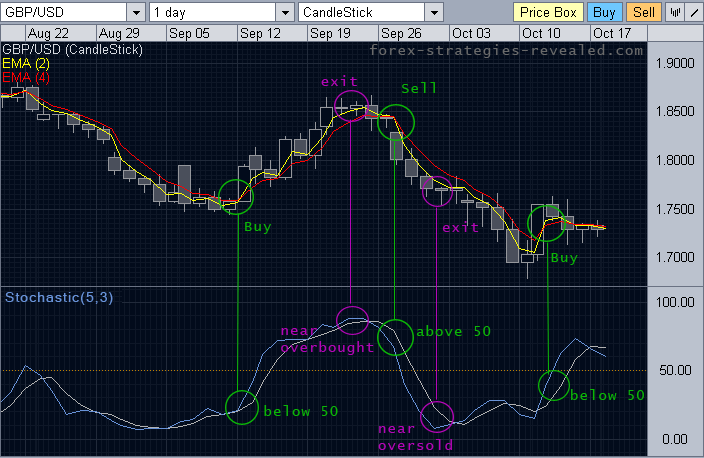

I have developed a new strategy and it is based on stochastic and exponential moving average. Although it is very simple but it is very effective for short term trading.

The strategy is as follows.

Time frame - Daily.

Indicators - Stochastic (5,3)

2 Days exponential moving average.

4 Days exponential moving average.

Buy Setup - Stochastic(5,3) should be BELOW 50.

Buy when 2 Days EMA crosses 4 Days EMA from

downside to upside.

Short Sell when 2 Days EMA crosses 4 Days EMA

from upside to downside.

Stop loss - Below low of the Entry day but it should not be more than 3 % from your entry price this is my way of using stop loss but you can use stop loss as per your risk appetite but try to maintain Risk:Reward ratio of at least 1:3.That is if your target is 15 your stop loss should not be more than 5.

Target - Exit when Stochastic(5,3) reaches near overbought zone i.e near 80 if you are long.

Exit when Stochastic (5,3)reaches near oversold zone i.e. near 20 if you are short.

2 Days and 4 Days emas crossover provides early entry into the trend and stochastic helps to filter out false signals.

I have tried my best to keep this as simple as i can and i hope everyone will like this strategy.

No comments:

Post a Comment