Quick Summary

Trading with MACD indicator includes the following signals:

MACD lines crossover — a trend is changing

MACD historam staying above zero line — market is bullish, below — bearish.

MACD histogram flipping over zero line — confirmation of a strength of a current trend.

MACD histogram diverges from price on the chart — signal of an upcoming reversal.

Details

MACD is the simplest and very reliable indicators used by many Forex traders.

MACD (Moving Average Convergence/Divergence) has in its base Moving Averages.

It calculates and displays the difference between the two moving averages at any time. As the market moves, moving averages move with it, widening (diverging) when the market is trending and moving closer (converging) when the market is slowing down and possibility of a trend change arise.

Basics behind MACD indicator

Standard indicator settings for MACD (12, 26, 9) are used in many trading systems, and these are the setting that MACD developer Gerald Appel has found to be the most suitable for both faster and slower moving markets. In order to get a more responsive and faster performance from MACD one can can experiment with lowering MACD settings to, for example, MACD (6, 12, 5), MACD (7, 10, 5), MACD (5, 13, 8) etc.

These custom MACD settings will make indicator signal faster, however, the rate of false signals is going to increase.

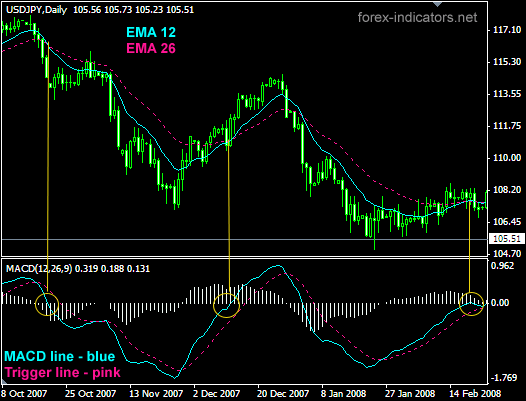

MACD indicator is based on Moving Averages in their simplest form. MACD measures the difference between faster and slower moving average: 12 EMA and 26 EMA (standard).

MACD line is created when longer Moving Average is subtracted from shorter Moving Average. As a result a momentum oscillator is created that oscillates above and below zero and has no lower or upper limits. MACD also has a Trigger line. Combined in a simple lines crossover strategy, MACD line and trigger line crossover outperforms EMAs crossover.

Besides being early on crossovers MACD also is able to display where the chart EMAs have crossed: when MACD (12, 26, 9) flips over its zero line, if indicates that 12 EMA and 26 EMA on the chart have crossed.

How does MACD indicator work

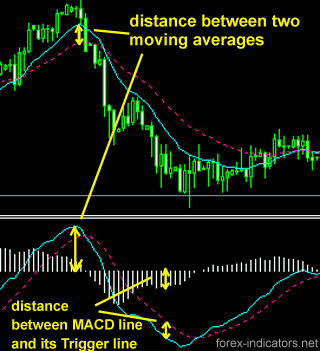

If to take 26 EMA and imagine that it is a flat line, then the distance between this line and 12 EMA would represent the distance from MACD line to indicator's zero line.

The further MACD line goes from zero line, the wider is the gap between 12EMA and 26 EMA on the chart. The closer MACD moves to zero line, the closer are 12 and 26 EMA.

MACD histogram measures the distance between MACD line and MACD trigger line.

MACD indicator Formula

MACD = EMA(Close)period1 - EMA(Close)period2

Signal Line = EMA(MACD)period3

where

period1 = standard settings are 12 bars

period2 = standard 26 bars

perid3 = standard 9 bars

The following are the steps to calculate MACD

1. Calculate the 12-days EMA of closing price

2. Calculate the 26-days EMA of closing price

3. MACD = 12-days EMA - 26-days EMA

4. Signal Line = 9-days EMA of MACD

Formula for EMA

EMA = (SC X (CP - PE)) + PE

SC = Smoothing Constant (Number of days)

CP = Current Price

PE = Previous EMA

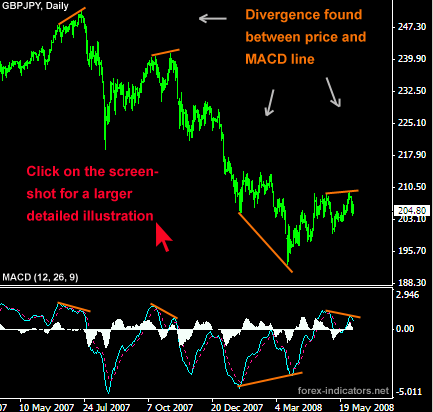

Trading MACD Divergence

MACD indicator is famous for its MACD Divergence trading method.

Divergence is found by comparing price shifts on the chart and MACD values.

MACD Divergence phenomenon occur as a result of shifting forces on the Forex market.

For example, while Sellers may seem to be dominating the market at the moment and price continues to trend down, there already might be signals for an overall weakening of Sellers power. This key warning moments can be observed with MACD indicator. What Forex traders would see is that despite price making new Lower Lows, MACD doesn't confirm that and instead registers a Higher Low, signaling that Sellers are running out of steam and a trend change is on its way.

Opposite will be true for Buyers.

How to trade MACD Divergence

When MACD line (on our screenshot it is a blue line) crosses Signal line (red dotted line) - we have a point (top or bottom) to evaluate. With two most recent MACD line tops or bottoms find corresponding tops/bottoms on the price chart. Connect MACD tops/bottoms and chart tops/bottoms.

Evaluate the lines received, as shown on the larger screenshot (click on the small picture to enlarge).

With MACD divergence spotted Enter the market when MACD line crosses over its zero point.

Another entry strategy is to find 2 most recent swings high or low on the chart and draw a trend line trough them; and then set an Entry order on the breakout of that trend line.

MACD divergence trading method used not only to predict trend turning points, but also for trend confirmation. A current trend has high potentials to continue unchanged in case no divergence between MACD and price was established after most recent tops/bottoms evaluation.