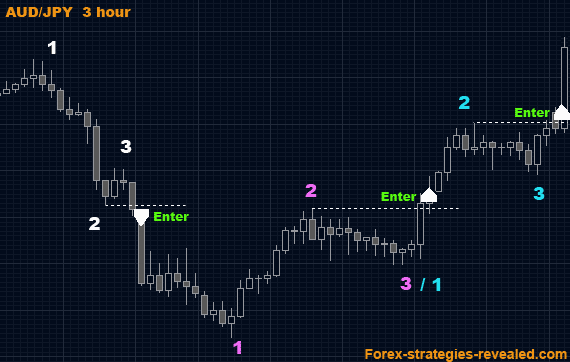

Forex trading strategy #13 (Simple 1-2-3 swings)

And here we are again talking about the strategy that withstood the test of time. This Forex trading method is based on the same study of defining support and resistance levels and trading upon the fact of their violation.

A trading setup requires only an open chart and no restrictions for the currency or timing preferences.

Entry rules: Once the price makes it through the “pivot Line” - dotted white line on the figure below (drawn using the latest price peak) - and closes above (for uptrend) or below (for downtrend) the line buy/sell accordingly.

Exit rules: not set. However, exit can be found using Fibonacci method; or traders can measure the distance between point 2 and point 3 and project it on the chart for exit.

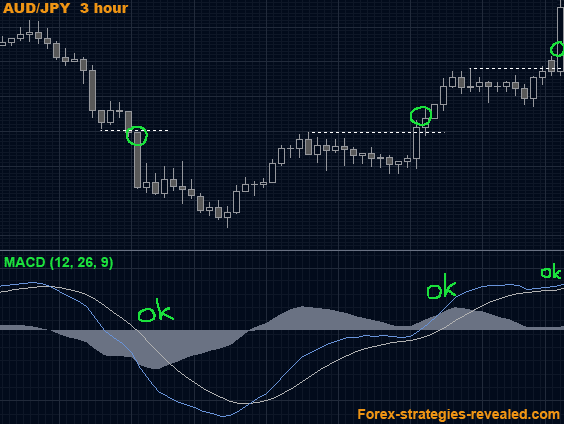

Additions: as an additional tool traders can use MACD (12, 26, 9). The rules for entry then will be next - let’s take a SELL order:

When MACD lines cross downwards, you look for 1-2-3 set-up to form. When the price starts “attacking” the “pivot Line” you check that MACD is still in SELL mode (two lines are heading down). Once the price closes below the “pivot Line” – place Sell order.

Same chart: MACD (12, 26, 9) is added.

Advantages: gives 100% profitable entries.

Disadvantages: does not advise on exits.

http://forex-strategies-revealed.com/

No comments:

Post a Comment